亚洲AV手机电影丨麻豆AV一区二区三区丨国产AV一区二区三区传媒丨2024最新国产精品网站丨夜夜爽天天要丨久久久久国产精品三级网丨亚洲福利精品A级片专区丨国产精品视频第一区二区三区 Intelligent mobile phone

The winter is coming, is spring still far away?

Time flies, in the face of the global smartphone market is becoming increasingly saturated, product homogeneity is serious, and the replacement cycle is prolonged. In 2017, the Chinese mainland market experienced a cold winter. According to institutional data: In 2017, the shipment volume of the smartphone market in mainland China was about 468 million units, down 6.2% year-on-year. Especially in the second half of the year, the overall shipments fell by double digits. According to the model calculation, with the launch of new brands in the second quarter of 2018, the market will show signs of bottoming out.

The colder the winter, the more eager for "warm"

“Comprehensive Screen” has become a key word, and it has been running through 2017 for a whole year. According to the data, in the past 2017, the global total screen smartphone shipments were about 130 million units, of which the shipments of smartphones in mainland China were about 22 million units, and the penetration rate reached 16% in the fourth quarter. The popularity of comprehensive screens has become an irreversible trend in the industry chain.

2017 mainland smartphone full screen penetration rate%

The technical development trend of smart phone panels mainly focuses on three aspects of “image quality, appearance and function integration”. Nowadays, with the gradual maturity of traditional display technologies, the display performance of LCD or OLED panels has reached a high level.

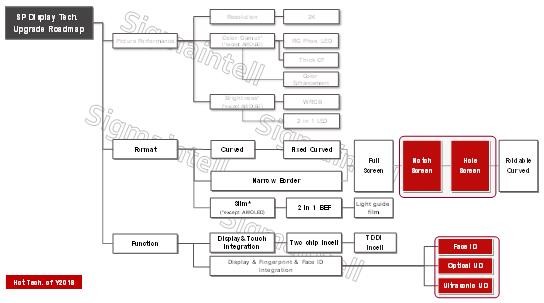

The topic of "full screen" left it in 2017. Looking forward to the global smartphone display technology upgrade in 2018 will continue to focus on the two aspects of “look and feel” and “functional integration”. Institutions combined with the display of industrial development, the smart phone technology trends are as follows:

2017-2018 mobile phone display technology development roadmap

Appearance: From "Liu Haiping (Notch)" to "Hole", constantly challenge the viewing area

"Liu Haiping"

The mobile phone display breaks through the traditional 16:9 aspect ratio and develops toward 18:9, 19:9, 20:9 or even more slender, increasing the viewing area of the mobile phone screen. Taking a 5.5-inch 16:9 product as an example, if you switch to a full 18:9 screen, the display can be increased to 6 inches and the visible area is increased by 10% while maintaining the overall width. If you switch to the 18.7:9 full profile screen, the display size can be increased to 6.2 inches and the viewing area is increased by 16%.

Visual area improvement comparison chart

In 2017, Apple released the iPhoneX's “Liu Haiping” high-end smartphone. This innovative design caused a lot of controversy at the beginning of the exposure. But in any case, it increases the visibility of the smartphone, but also increases the consumer's recognition of the brand. Domestic mobile phone brands will have a number of special-shaped screen phones available in 2018. According to Sigmaintell data, as of December 2017, there are more than 20 shaped screen smartphones in planning and development.

Compared with ordinary full screens, the wide-ranging popularity of heterosexual screens will encounter the following five major challenges:

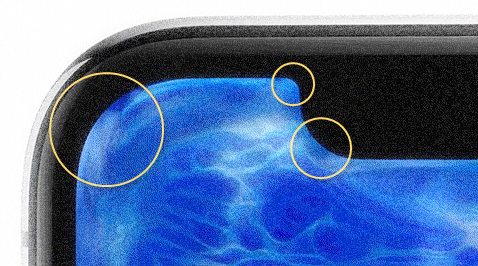

First, the design of the slotted portion of the panel is relatively difficult, similar to the four corners of the full screen display area. The corner of the slotted portion is usually an R-angle shape, so the layout of the display line needs to be redesigned.

Slotted part enlargement

Second, due to the differences in the size of the slotted parts of different brands, the algorithmic requirements for the driver IC are differentiated. If the display also uses the TDDI drive method, the tuning requirements for the driver IC are higher.

Third, the LCD shaped screen has a much larger change to the backlight, and the overall structure of the backlight and the various internal materials need to be matched for the corresponding slots.

Fourth, the cutting of the screen itself also needs to increase the corresponding cutting equipment, which increases the capital investment (although the mainstream panel factory has increased the corresponding investment).

Fifth, the use of special-shaped screens also imposes higher requirements on the adaptability of mobile phone hardware (including cameras, earpieces, etc.) and software (operating system, etc.), which inevitably increases the cost of other components.

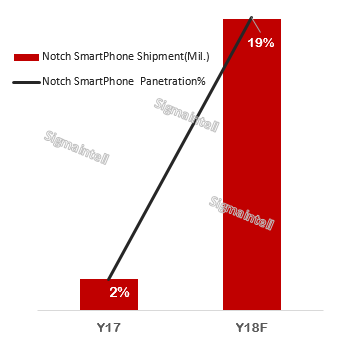

In short, the adoption of heterosexual screens will undoubtedly increase the cost of hardware and software, and eventually the brand factory has to pass on this part of the cost to the end consumers. Today, as the prices of bulk raw materials around the world continue to rise, the cost pressure of shaped screens will be a challenge that terminal brands have to face. The organization still maintains a conservative attitude towards the rapid increase of the full screen. It is estimated that the shipment of global heterosexual screen smartphones will reach 280 million pieces in 2018, and the penetration rate will increase from 2% to 19%, and more of them are contributed by Apple. .

2017-1818 global heterosexual screen smartphone shipments and penetration trends (million,%)

"Digging screen"

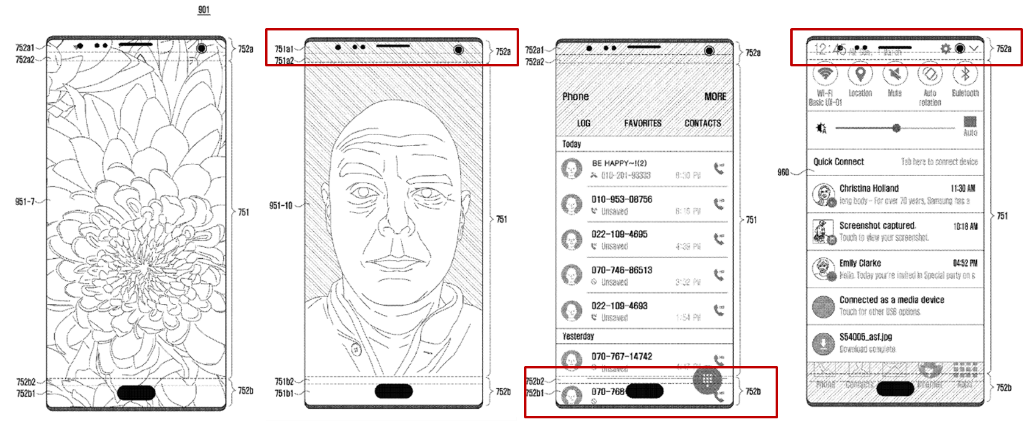

Samsung Galaxy recently announced its patent application for the “digging hole” screen (I believe many friends have carefully reviewed the patent details), so it is still necessary to wait and see whether the “digging screen” can lead the development trend of the full screen. Compared with "Liu Haiping", "digging hole screen" undoubtedly enhances the visual area of the mobile phone display screen, and is incomparably close to the concept of "full screen". At the same time, it also enhances the fashion and technology of the overall appearance of the mobile phone, and is more attractive to consumers. Undoubtedly, its challenge to the industrial chain is also quite high. In addition to looking forward to the new Galaxy Note9 in the second half of the year or the new S10 next year, domestic machine manufacturers have also begun to consider and increase the research and development efforts on the “digging hole screen”. Panel makers are also increasing their development efforts in this area.

圖6:三星全面屏“挖孔“專利

Functional integration: Y-OCTA / screen fingerprint, Face ID

Y-OCTA is gradually maturing

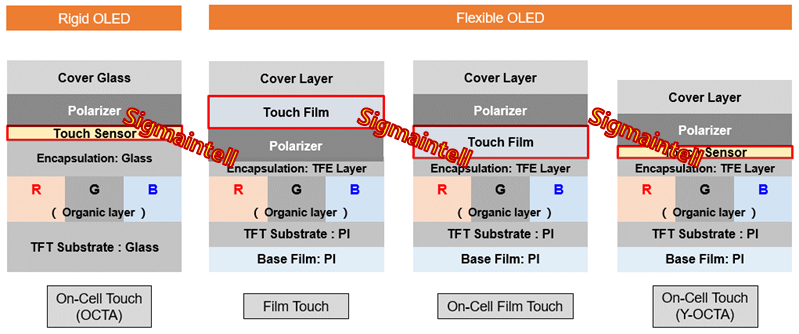

In the LCD field, with the popularity of LTPS (low temperature polysilicon) LCD, In-cell touch technology is widely used, but in the field of OLED is still based on On-cell touch technology. For rigid OLEDs, in order to solve the shielding effect of the cathode on the In-cell touch circuit, it is necessary to form a patterned cathode in the encapsulation layer to avoid shielding, which increases the mask evaporation step and further reduces the yield. However, in the On-cell touch method, the process of forming ITO on the upper portion of the package glass does not require the use of an evaporation process, and the lithography work can also be outsourced. Therefore, the On-cell touch technology has always been the choice of the touch scheme of the rigid OLED.

However, the situation has changed after the implementation of flexible OLED products. Since the flexible OLED needs to use Thin Film Encapsulation (TFE), the encapsulation layer in this step needs to be formed in the OLED production line and cannot be outsourced. Therefore, it is necessary to use the lithography productivity inside the panel to realize the touch function. Therefore, in order to leave the production capacity of the OLED production line to a more profitable screen production, the touch scheme of the flexible OLED screen at present is mostly in the form of a touch film, that is, by attaching a touch ITO film to the upper or lower portion of the polarizer. Implement touch functionality. This kind of scheme is mature in technology, but there are also problems of poor light transmission and large thickness.

As a leading global OLED manufacturer, Samsung used the Y-OCTA screen (Youm On-Cell Touch AMOLED) developed for flexible OLEDs in the 2017 Galaxy S8 mobile phone, first coating the film on the film encapsulation layer to improve the flatness. The touch circuit is then directly generated on the encapsulation layer by a photolithography process. Flexible displays using this technology perform better in terms of functional integration, screen thickness and light transmittance. In 2018, Samsung will fully use the Y-OCTA display in the Galaxy S9 and Note9 series of high-end mobile phones, which means that the flexible On-cell touch technology will become more mature.

Rigid OLED, flexible OLED touch technology trends

Under Screen Fingerprint (Under Display)

First of all, the "full screen" trend has come so fast, the brand terminal factory new project cancels the pre-fingerprint.

Secondly, at the end of 2016, its high inventory of chip stocks, in 2017, the mobile phone industry suffered a "cold winter."

Moreover, the rapid rise of domestic fingerprint identification solutions, chip prices have been falling.

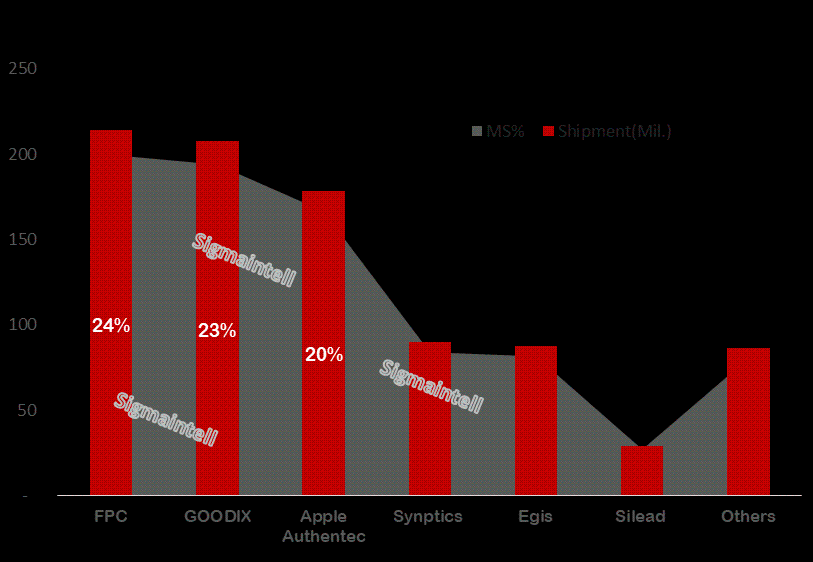

It is not surprising that this situation is caused. According to preliminary statistics, the global shipment of fingerprint chips in 2017 was about 980 million, an increase of over 30% year-on-year, of which FPC/Jingding's shipments exceeded 200 million. Fingerprint identification has become the standard component of mobile phones. Although the volume of shipments has increased significantly, the product structure has undergone a major reversal. The demand for mid- to high-end such as the cover type has dropped significantly. The increase is mainly due to the demand for low-end Coating coating.

Global fingerprint chip shipments and share in 2017 (million,%)

As we all know, the screen fingerprint technology is mainly divided into optical and ultrasonic, and both need to be equipped with an OLED screen. The optical screen fingerprinting scheme represented by Xinsi and Huiding has gradually matured. At the global CES exhibition in 2018, vivo was the first to launch the vivo X20PlusUD screen fingerprint phone with Synaptics Clear ID FS9500 optical fingerprint sensor. Although it is still in the water test stage, the domestic mainstream brand factory has entered the trial of small batch projects. At the production stage, it is expected that in the second half of 2018, there will be more smartphones with fingerprint solutions under the screen. The current optical fingerprinting scheme is more based on silicon wafers, and the optical fingerprinting scheme using glass substrates still needs to be continuously improved by the panel manufacturer's research and development technology.

Another solution is the ultrasound solution, which is mainly based on Qualcomm and FPC. At present, it is still in the pre-research stage. Since the ultrasonic solution must be equipped with a flexible OLED screen, the whole product will be listed later than the optical fingerprint product. It is expected that the ultrasonic whole opportunity will be gradually listed in the second half of 2018. Compared with the optical screen scheme, the ultrasonic scheme has advantages in terms of mass production cost and strong penetration. With the medium and long-term flexible OLED volume, from the technical route, the screen fingerprint of the ultrasonic solution may usher in a better development.

2018 will be the first year of development of fingerprints under the screen. Both optical and ultrasonic fingerprints will be available in mass production models. The widespread use of technology still requires further maturity of the supply chain. Perhaps it will attract market in 2019. High-speed growth.

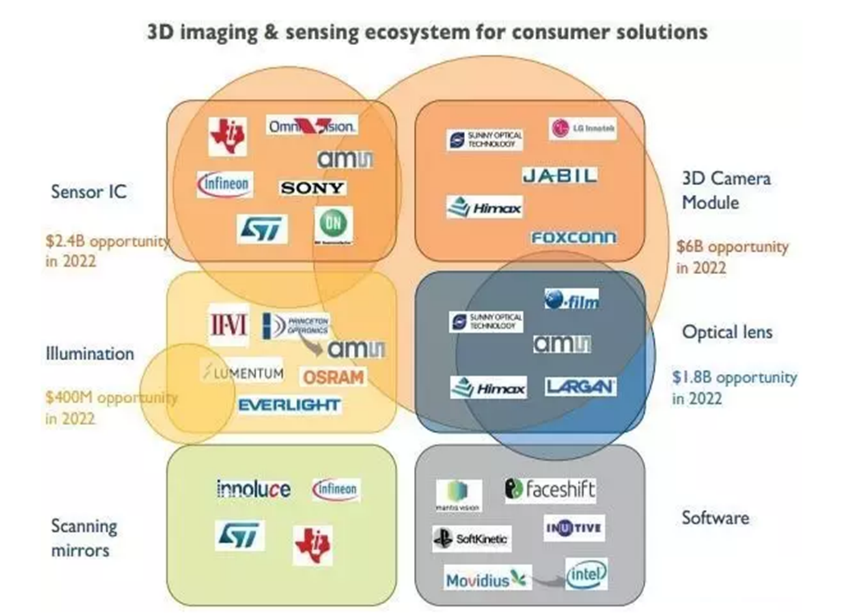

Face ID (3D structured light)

Apple's direct elimination of the fingerprint identification scheme on the iPhoneX and the use of the Face ID (3D structured light) facial recognition scheme have had a significant impact on the industry. The technical difficulty of 3D structured light is not in hardware, and the hardware supply chain is relatively mature. It is really difficult to still be in the algorithm, including Qualcomm, the company with AP platform has been increasing research and development efforts, hoping to break through the algorithm as early as possible, the development of Face ID is still subject to the maturity of the supply chain. It is expected that brand manufacturers (non-Apple) will be the first to carry out small-scale trial production of Face ID (3D structured light) products in the second half of this year.

3D structured light main supply chain manufacturer

Under-screen fingerprint recognition technology and facial recognition technology will compete for the future of high-end mobile phone recognition technology in 2018. It is expected that the two biometric technologies will coexist in the future. As for who will be better, it will be waiting for the whole machine. The mass production of the products is on the market.

In summary, in 2018, the smart phone display technology will be developed around the “groove” and gradually derived into the “digging hole” solution. Functional integration will focus on "screen fingerprints" and "Face ID", and the flexible OLED's "Y-OCTA" touch method will become more mature. “Fast” is a major feature of the development of the smart phone industry chain. The supply chain, new technologies, and business models are all changing rapidly. Many factors determine the rise and decline of the terminal brand.